Retail industry operations and processes have been under constant change ever since the evolution of technology. Retailers who quickly adapted to change faced fewer challenges than those who couldn’t, especially regarding financial management.

Being a significant element of any retail business, accounting for retailers usually becomes challenging due to various other crucial responsibilities that need more attention. As finances are the foundation of a company, financial management challenges can potentially break the entire business if not met on time.

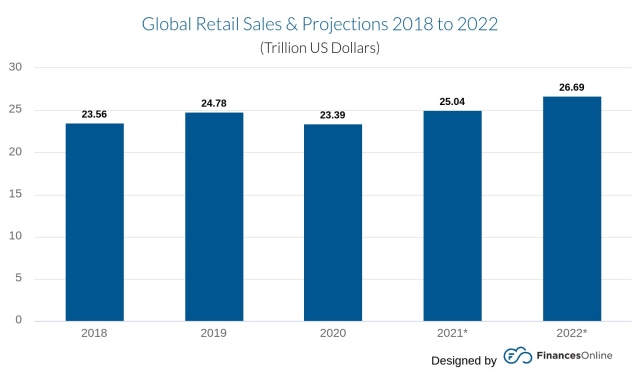

Many retail companies have filed for bankruptcy since 2017, and in the aftermath of the COVID-19 outbreak, more retailers had to close their businesses. So let’s check these stats shedding some light on the figures.

- There were 442,597 retail stores in the US in 2019 (NACS, 2020)

- In December 2020, the US retail market saw a month-over-month decrease of 0.7% (US Census Bureau)

However, the overall market growth was not affected. Take a look at the graph below.

While the global retail market is going well, countries need to make sure small- and medium-sized retail businesses and even large retail companies do not bear the loss in the wake of any crisis. This can be beneficial for all – owners, employees, and customers. Here are some policy measures that countries can take to enhance the retail sector’s resilience, ensuring the least effects a crisis in the future.

- Liquidity assistance schemes should be rolled out for retail businesses of all sizes

- Help essential-item retailers manage labor supply shortages

- Provide support in implementing social distancing norms and guidelines

- Make sure competitiveness remains sufficient

- Help brick-and-mortar retailers connect with online distributors, helping them with business continuity amid emergencies

What’s Happening in the US Retail Market?

According to The US Census Bureau, the US retail market experienced year-over-year growth of 2.9% recorded in December 2020. Gathering the numbers, the total retail sales in the US for the entire 2020 indicated a 0.6% growth compared to 2019. Still, the unemployment rate in retail was as high as 6.7% in November 2020 in comparison with 2019. Out of many reasons, lack of funds, or we should say, lack of adequate financial management, was one big reason behind unemployment and retail businesses getting shut.

Considering that financial challenges must be met to survive and, in fact, thrive in the retail industry, let’s go further and read what experts say about economic difficulties in retail and ways to avoid them.

1. Cindy Corpis, CEO of SearchPeopleFree

Challenge 1 – Cash Flow Problems

For most business owners, managing cash flow is a never-ending battle. In addition to covering key recurrent expenditures like salary and rent, you must also pay company taxes, settle vendor invoices, and buy supplies and equipment to keep your business running.

Solution

You could also wish to optimize your company’s payment procedure so that customers can pay you more quickly and easily. Another alternative is to pay your providers in installments.

Challenge 2 – Marketing

Small businesses find it challenging to compete with huge, dollar-intensive marketing campaigns.

Solution

You’ll have to get imaginative if you want to stay competitive without depleting your cash reserves. Rather than just advertising, try creating useful SEO content.

2. Gerrid Smith, Chief Marketing Officer at Joy Organics

Excessive Debt

Entrepreneurs are understandably proud of their ability to “bootstrap” their way to success, therefore it’s not uncommon for them to take on debt to get their enterprises off the ground. However, there is such a thing as having too much corporate debt. Perhaps they racked up a bit too much debt on a personal credit card, or their local banker provided a line of credit that is now depleted and has a high-interest rate.

Regardless of the loan instrument used, these scenarios can have severe short- and long-term consequences for the organization. For example, it can take time for a company’s positive cash flow to begin, and employees, suppliers, and overhead must be paid in the interim.

3. Adam Wood, Co-Founder of RevenueGeeks

Challenge – Badly Timed Credit Terms

You might be fortunate enough to have credit terms that are totally in sync, meaning that the credit terms provided by your suppliers match exactly what you’ve set for your consumers. However, for many business owners, this is not the case. For instance, you can find yourself in a situation where your clients have 20 days to pay you, but your suppliers want payment within a week. This is when cash flow issues begin to appear.

Solution – Put Financial Measures in Place

If your credit conditions are out of sync, the first step any merchant should take is to try to renegotiate terms with customers or suppliers. Unfortunately, this is not always an option, so you’ll need to have some financial backing in place for your retail firm. Invoice financing might be the solution you’re looking for. It’s when a financial institution gives a company a short-term loan that’s secured by the invoices you’ve previously sent out.

4. Dan Close, Founder & CEO at Buy Houses In Kentucky

Challenge – Not Paying Bills on Time

It’s important for suppliers, landlords, and utilities to get paid on time. The occasional late payment may go unnoticed, but remitting payments repeatedly late can be very costly to a small firm. Damaged supplier relationships, being cut off from vital services, and being perpetually behind on debt payments can all have a tremendous influence on a company’s financial well-being and performance.

Accounts payable (AP) activities are still handled manually by 55 percent of organizations, according to PayStream Advisors’ research. To do so would be time-consuming as well as prone to fraud and errors. As well as helping to eliminate data entry errors and fraud through a set of “touchless” controls that run behind the scenes, an automated system saves money and time. Combining all of these features, accounts payable automation software offers significant advantages to organizations that use it.

Solution – Automating AP Tasks

By automating AP tasks, financial employees can save time and effort. The usage of an automated system can be used to submit invoices, manage the invoice approval process, and transmit payments to vendors instead of manually monitoring vendor bills.

5. Gerrid Smith, Chief Marketing Officer at Joy Organics

Costs are not being Forecasted Effectively

In the retail industry, failing to have the correct process when it comes to buying shares can quickly lead to cash flow issues. If there is no fixed purchasing budget in place, businesses may end up buying too much inventory. Merchandise handling is a time-consuming operation that varies depending on the type of product, the quantity of the delivery, and the destination of the items. But, like with anything in retail, the most important part of the transaction is the payment. Preparing for merchandise receipts ahead of time can help with cash flow issues.

6. Tanya Zhang, Co-founder of Nimble Made

Obtaining New Consumers

For at least the next few months, bringing customers back to the store will be one of the most difficult tasks. Consumer behavior will alter, and consumers may be less inclined to leave their homes and visit retailers. One of the most important methods that offline merchants may employ is to adhere to all safety precautions and reassure their clients. Apart from that, enticing EMI offers can assist in regaining clients. The possibility of delivering no-cost EMI directly at the point of sale can assist shops in quickly selling products, particularly high-ticket items.

7. Sally, Co-founder at FastPeopleSearch.io

Many retail businesses are experiencing challenges today, with the most significant being that of financial problems. Businesses need to take care of their finances to ensure that they can succeed and grow. This is where it becomes essential for them to identify signs of trouble to solve their money issues before it starts affecting them too much. As a business owner, here are some things you should know about financial challenges faced by retail businesses and ways on how you can avoid them:

Challenges faced by retail businesses

- Inadequate storage facility

- High inventory

- Customer complaints

Different signs can be looked out for to know if financial difficulties may start affecting a retail business. Here is the list of them:

Signs of trouble

- Declining sales figures

- Late payments from suppliers and employees

- Poor cash flow management

- Lack of focus

What can be done

- Retailers must focus on improving cash flow through better inventory management practices

- They also have to make sure they have a good understanding of what’s happening with the prices of commodities used in production

- They should also avoid making speculative investments to ensure they don’t lose their capital

- Retailers need to understand the tools used in financial forecasting so as to be able to plan for upcoming challenges

8. Dean, Kitchen Infinity

Challenge – Having A Healthy Inventory

You might need to buy in bulk for an upcoming event or the holiday season, which means you’ll be out of pocket until the merchandise is sold. Maintaining the correct inventory for your retail business can be tricky. Customers expect their demands to be addressed, but having enough inventory might be costly. Purchasing inventory in advance reduces a company’s cash flow, and no merchant wants to be pushed to lower prices to get the merchandise off the shelves when the time comes. A cash flow problem could arise unless your store maintains cash reserves to help combat these hectic periods as they arise.

Solution – Consider Bulk Discounts

To prevent selling your stock at a loss, you could consider offering discounts to customers who purchase large quantities of your products. You must decide which is best for your business: keeping products on the shelves longer than anticipated, resulting in a lower price, or selling huge volumes of stock at a reduced price, allowing you to conserve space and move on to the next batch of items.

Conclusion

After gaining valuable tips from these experts, we now know efficient financial management is challenging but not impossible, and you can use good retailing software to manage it smoothly. For example, while many choose to outsource for retail business accounting, several retailers manage it in-house, and many handle it independently,

Since finance management and accounting are interlinked, your next best action as a retail business owner should be to establish a process that can synchronize both and other functions crucial for better financial performance. After all, that is all you need to unlock growth and expansion.