Growing optimism that record-breaking inflation rates are showing signs of peaking has led to a cautious restoration of confidence in stock markets around the world. With some market commentators expecting interest rates to settle down in the coming weeks, investors are increasingly looking at new opportunities to buy into undervalued stocks.

In the US, the expectation that the Federal Reserve will lower interest rates is likely to lead to investors returning to risk-on positioning, with leading banks like JP Morgan recommending growth stocks as a strong tactical purchase for greater upside.

This news comes in the wake of the Fed introducing a heavily tightening monetary policy in March 2022 with a 25-basis-point rise in interest rates. In the months that have followed, interest rates have grown by a further 125 basis points, and most recently, a 75 basis points hike was introduced in recent days as a means of tackling levels of inflation that haven’t been seen for 40 years.

Despite such a significant flurry of hikes, JP Morgan has expressed its confidence that inflation levels have peaked, owing to evidence based on falling PMIs, a peaking US dollar, a weakening job market, and a steep decline in oil prices.

Significantly, a 20% drop in oil prices has been seen as an indicator of falling demand, which points to a slowdown in inflation.

“The reset in activity is what many want to see in order to be able to start looking through, positioning for the inflection higher,”

MISLAV MATEJKA, HEAD OF GLOBAL AND EUROPEAN EQUITY STRATEGY AT JP MORGAN

These economic declines also apply to wider corporate earnings. Although these factors are certainly negative in appearance, they can also indicate that a market bottom has finally arrived.

“The bearishness on earnings is pretty unanimous, which we argued could lead to a phase of weaker earnings being seen as good. Q2 results are coming out softer than typical, but equity markets have been holding up well through these”.

Matejka

Evidence of Recovery on Both Sides of the Atlantic

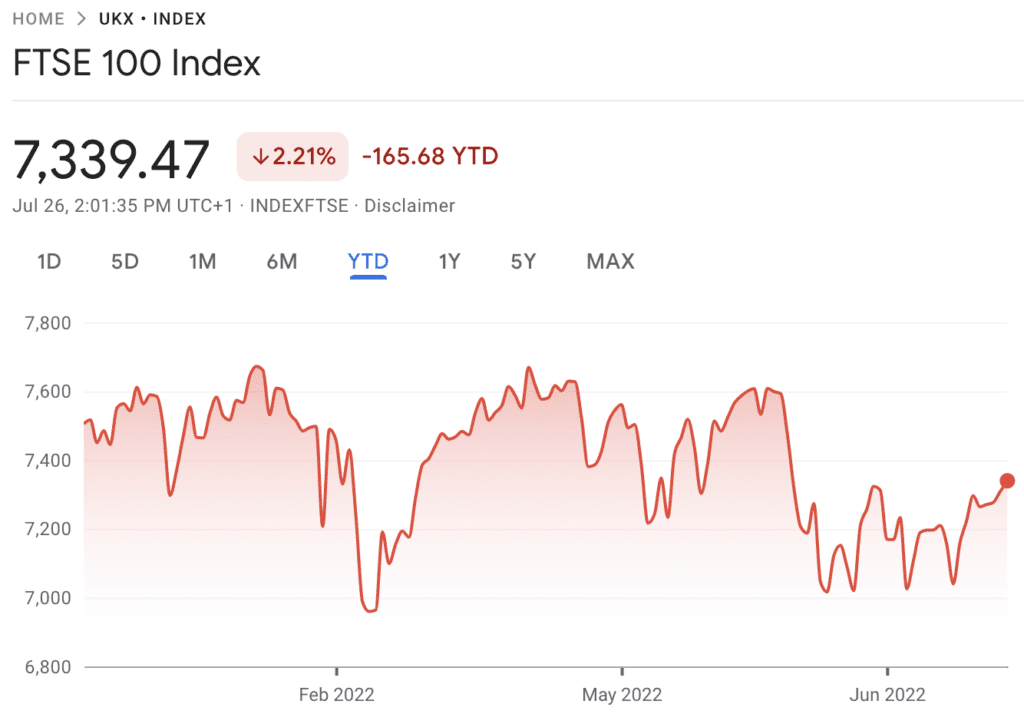

In the United Kingdom, the FTSE 100 has also shown signs of life following a profoundly difficult start to 2022.

After a seismic correction at the beginning of the year, owing to the emergence of record-breaking inflation, the outbreak of war in Ukraine, and a heavy cooldown in the wake of a flurry of investor activity throughout late 2020 and 2021, many stocks on the FTSE 100 tumbled significantly.

As the data above shows, the FTSE 100 has recovered to make up much of the lost ground of 2022 already. As geopolitical conflict marred the market’s progress in February, the FTSE 100 declined by as much as 9.29%. Now, after a period of volatility, we can see a strong upwards movement that has been gathering momentum throughout July.

The underwhelming performance of many of the businesses that have occupied the FTSE 100 has opened up fresh buying opportunities for investors who are seeking to identify undervalued stocks.

According to analysts at The Economy Forecast Agency, the FTSE 100 is poised to recover from its negative price movements and has the potential to surpass 8,000 points by December 2023. Should the market rally to such an extent, investors are likely to see widespread growth throughout their portfolios.

For context, the FTSE 100 has never reached 8,000 points, with the closest attempt to break the milestone coming in the first half of 2018.

Such a resounding recovery is likely to come as a massive boost to the UK’s fledgling fintech sector, which is populated by an extensive range of leading trading and investing platforms geared towards retail investors.

Cause for Caution

Despite widespread optimism emerging from both sides of the Atlantic, Morgan Stanley Wealth Management has warned that it may be too early to assume that stocks and shares are fully out of the woods.

Specifically, the bank has warned that the Federal Reserve’s interest rate hikes could lead to further corrections.

Despite the S&P 500 climbing by nearly 5% in July, the lingering presence of high inflation may lead to the index becoming far too overvalued – even though rates could have already peaked.

“Stock market pricing seems premature. The latest bear market rally in our view is full of wishful thinking,”

Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management.

Shalett notes that the Federal Reserve historically only begins to loosen its stringent interest rates when the core personal consumption expenditure index has fallen below its target rate. This index is generally used by the Fed as a means of measuring inflation whilst excluding more volatile food and energy prices.

This indicates that the cloudy skies may not clear for a little longer yet. However, with signs that inflation has indeed peaked, investors can still look to new buying opportunities. Given that a market recovery may take a little longer than initially forecast, it may afford more time to discover stronger underpriced stocks in the meantime.